Tax-Free Savings Accounts (TFSAs) for Newcomers in Canada

Tax-Free Savings Accounts (TFSAs) for Newcomers in Canada

As a newcomer, you may want to start investing and saving for your future shortly after moving in. You must know the financial tools available to help you save and grow your finances. A Tax-Free Savings Account (TFSA) is one of the most potent options and stands out among others. It offers residents, including newcomers, a unique way to save and invest money while enjoying significant tax benefits.

Whether saving for short-term goals, building an emergency fund, or planning for the future, TFSAs can play a vital role in your financial strategy. This guide will explain everything you need to know about TFSAs as a newcomer, helping you make informed decisions about your financial future in Canada. Sit, relax, and read on!

Read: Working in Canada vs Working in the US: A Comparative Analysis

What is Tax-Free Savings Accounts (TFSAs)?

A Tax-Free Savings Account is a unique financial vehicle designed to help Canadians save and invest money with significant tax advantages. It allows your money to grow tax-free, meaning you won’t pay taxes on interest, dividends, or capital gains earned within the account. This tax-free growth can significantly boost your savings over time.

Understanding that a TFSA is not a magical wealth-growing account is important. To benefit from a TFSA, you must actively invest the funds within it, such as stocks, mutual funds, or other investments. The account’s growth potential depends on how you use it as an investment tool.

Eligibility for Newcomers

As a newcomer to Canada, you may wonder if you can open a TFSA. The good news is that TFSAs are accessible to many residents. You can open a TFSA if you meet the following criteria:

- Age: You must be 18 years or older.

- Social Insurance Number (SIN): You need a valid SIN to open a TFSA.

- Residency: You must be a resident of Canada for tax purposes.

It’s important to note that no minimum residency period is required to open a TFSA. It means that even if you’ve just arrived in Canada, as long as you have a valid SIN and are considered a resident for tax purposes, you can benefit immediately from a TFSA.

Benefits of TFSAs for Newcomers

Let’s discuss the unique advantages TFSAs offer that make them attractive for newcomers to Canada:

- Tax-free growth: Your investments grow without being taxed, which helps you build wealth faster.

- Flexibility in withdrawals: You can take money out anytime without penalties or taxes.

- No income requirement: You don’t need Canadian employment income to contribute.

- Contribution room accumulation: Your TFSA room starts accumulating from the year you become eligible, even if you haven’t opened an account yet.

Read: Understanding Minimum Wage in Canada

How to Open a TFSA as a Newcomer

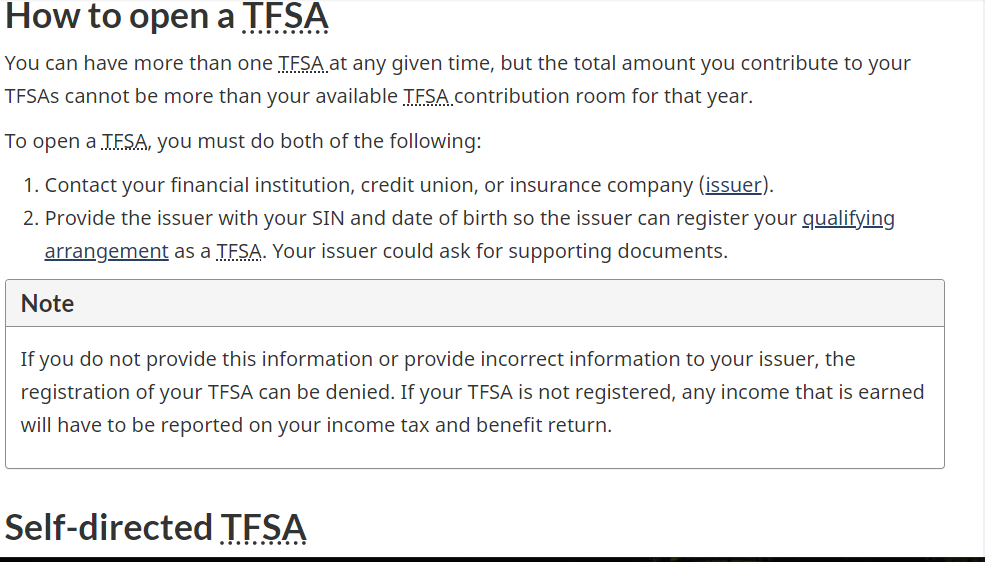

Opening a TFSA in Canada as a newcomer is straightforward. First, obtain a Social Insurance Number (SIN) by applying at a Service Canada office or online if you don’t have one.

Next, choose a financial institution to open your TFSA with, such as banks, credit unions, trust companies, or other online investment platforms. Compare options to find the best fit for your needs.

You’ll need to provide the required documentation, including your SIN, government-issued ID, and proof of address. Complete the application process, which can often be done online or in person at a branch. Finally, make your first contribution, starting with any amount within your contribution limit.

Investment Options Within a TFSA

One of the great features of TFSAs is the variety of investment options available. You can hold various types of investments within your TFSA, including:

- Cash savings: For those who prefer low-risk, easily accessible funds.

- Stocks and bonds: Individual securities for more hands-on investors.

- Mutual funds and ETFs: Diversified investment options managed by professionals.

- Guaranteed Investment Certificates (GICs): Fixed-term investments with guaranteed returns.

Your choice should align with your financial goals and risk tolerance.

TFSA Contribution Limits

Understanding TFSA contribution limits is crucial for effective financial planning. The current annual limit for 2024 is $7,000, but this amount can change yearly based on government decisions.

For newcomers, the TFSA contribution room accumulates from the year they become eligible, typically when they turn 18 and become Canadian residents. Your limit is calculated by adding all contribution rooms since you become eligible, subtracting your contributions, and adding any withdrawals.

Track your transactions carefully to avoid over-contribution penalties. While the Canada Revenue Agency (CRA) might provide limited information online, it is recommended that you keep your records.

TFSA vs. Other Savings Options in Canada

To fully appreciate the benefits, TFSAs must be compared to other savings options available in Canada. TFSAs offer more flexibility for withdrawals without tax consequences, while RRSP contributions are tax-deductible, and withdrawals are taxed as income. TFSAs are better for short—to medium-term goals, while RRSPs are primarily for retirement savings.

TFSA earnings are tax-free, while interest earned in regular savings accounts is taxable. Due to their ability to hold various investments, TFSAs often offer higher potential returns.

Compared to non-registered investment accounts, TFSA investments grow tax-free, whereas non-registered accounts are subject to annual taxation on earnings. Additionally, TFSAs have contribution limits, while non-registered accounts do not.

Read: Canada Startup Visa vs Self-Employed Work Permit: For Entrepreneurs

TFSA Strategies for Newcomers

Let’s discuss the key strategies to consider to make the most of your TFSA as a newcomer:

- Short-term vs. long-term goals: Use your TFSA for both immediate needs and future aspirations.

- Emergency fund: Keep a portion in easily accessible investments for unexpected expenses.

- Saving for major purchases: Accumulate funds for down payments or other significant costs.

- Long-term wealth building: Invest in growth-oriented options for long-term financial security.

Common Mistakes to Avoid

- Over-contributing: Exceeding your limit can result in penalties.

- Misunderstanding withdrawal rules: While you can withdraw anytime, replacing withdrawn amounts in the same year might lead to over-contribution.

- Non-resident contributions: If you leave Canada, avoid contributing to your TFSA to prevent tax complications.

Tax Implications for Newcomers

The beauty of TFSAs lies in their simplicity from a tax perspective. You don’t report TFSA earnings on your tax return, withdrawals don’t affect your eligibility for income-tested benefits or credits, and no tax is payable on funds withdrawn from your TFSA.

However, some international tax treaties might have implications for TFSAs. If you maintain financial ties with another country, consult a tax professional for personalized advice.

TFSAs provide flexible and tax-efficient savings options to newcomers in Canada. Understanding and strategically using TFSAs can help build a solid financial foundation. For best results, start early, contribute consistently, and align TFSA use with broader financial goals.